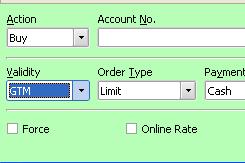

SGX and MAS have recently approved the use of GTM and GTD orders for retail clients since 15th of April. Many friends of mine have been asking me about the usefulness of this two functions. I will give my 2 cents here.

Usually for retailers, their validity is by day, which means you queue an order within the market day and it expires. Which means you will have to re queue again when market ends if you want the order queue to be in again the next day.

What GTD and GTM does is basically to carry forward unexecuted orders for a maximum of 30 calender days. GTD lets you specify a day within the 30 days and GTM carries forward until the full 30 days.

Do also note that for GTM/GTD orders, you cannot amend or cancel after market ends. You can only amend or cancel the order the next day at 8.30am onwards.

So whats so impressive you might ask? Well GTM/GTD orders are long dated which means there are never off the market.

If you wish to sell a particular stock at a price target that is hard to be done mainly due the the exorbitant sell queue infront of you, you can use GTM/GTD. As every day after market ends, your queue will not expire and it will be pushed infront of queues that have expired. This usually means that, after a few days, you will find your queue in front of the rest.

A very useful tool to have in my opinion. So do make sure you have a platform that supports these two functions.

Haven't you heard about cyber hacking company blank ATM card and how other people had benefited from it? I am Williams vivian by name, i want to share a blog and forums on how to get real blank ATM card,thank to cyber hacking company who helped me with an already hacked ATM CARD and i was so poor without funds that i got frustrated. One morning as i was browsing on the internet, i saw different comments of people testifying of how cyber hacking company helped him from being poor to a rich man through this already hacked ATM CARD. I was skeptical if this was true, i decided to contact him to know if he is real he proved to me beyond all doubts that its was really for real so i urgently receive my blank ATM card. Contact his email cyberhackingcompany@gmail.com and today am also testifying on how cyber hacking company helped me. I never believed in it until the card was sent to me, which am using today Contact the company now and become rich. Email: cyberhackingcompany@gmail.com

ReplyDeleteJust only few people already making money with this card but they refused to post it for others to know about it, am here to share this for everyone who wants to make cool money here is the opportunity to get your magic ATM card from Crown tecnology today and Become rich Whatsapp: +12134218707

DeleteI got my already programmed and Magic ATM card to withdraw the maximum of $2,500 daily for a maximum of 1 year. I am so happy about this because i got mine last month I have used it to get $30,000

Get yours Magic Atm Card from crown tecnology today and Become rich tell others re post it on your timeline or status email atm.tecnology@gmail.com

● Hello, we are offering service for Online CC /w High Balance which is ATM Card. You can use it anywhere in the world to withdraw money from any ATM machine. Contact us with the following email address: harrisonblankatmcard@gmail.com -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- --

Delete-- -- --------------What are the list, cost and how do i purchase the card? Contact us on: Email: harrisonblankatmcard@gmail.com

★ How it works? Our cards are loaded with balance of $5,000 to $100,000 with different daily withdraw limit depending on the card you are ordering and you can use the ATM card to withdraw cash anywhere.

★ Is this real? Yes, as shown in the video, we withdraw cash multiple times without any issues. You can do it too.

★ Can i be traced? No, your withdraw/transactions are completely anonymous.

★ Is this legal? We'll leave that for you to asnwer but we have not had any issues when doing this method. ★ Are people using this? Absolutely, people have quit most of their hard jobs to withdraw money instantly. Men and women use this card but we dont deal with kids or anyone below 18yrs

★ How do I get my card? We will ship your card with Pin 2 hours after receiving clear payment from you and the card will be send to you through courier delivery services. Our package usually delivered within 2-3 business day. Once you receive the card you can start cashing out.

★ Are you guys for real? YES: we are 100% real and been doing this since 2015 and once you withdraw with our card please do drop a comment right here for other people to see we are being serious here. -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- EMAIL US AT: harrisonblankatmcard@gmail.com or WhatsApp +15593840001

I just want to share my experience with everyone. I have being hearing about this blank ATM card for a while and i never really paid any interest to it because of doubts. Until one day i discovered a hacking my guy Pete. he is really good at what he is doing. Back to the point, I inquired about The Blank ATM Card. If it works or even Exist. They told me Yes and that it is a card programmed for only money withdraws without being noticed and can also be used for free online purchases of any kind. This was shocking and i still had my doubts. Then i gave it a try and asked for the card and agreed to their terms and conditions ... Four days later I received my card and tried with the closest ATM machine close to me, to my greatest surprise It worked like magic. I was able to withdraw up to $ 4,000 daily. blank ATM has really change my life. If you want to contact them, Here is the email.you can give it a try god bless you all.Haroldblankatm@gmail.com

ReplyDeleteI got my programmed and blank ATM card from Richard blank cards to withdraw the amount of US $500 per day for a maximum of 30 days at (richydonnas@gmail.com).

ReplyDeleteThough at first i was in doubt, but thank God i did not back-out I am very happy with this because i have successfully to paid my debt. Richard blank cards is true and real, Get yours from Richard blank cards today! You just have to send an email.

to (richydonnas@gmail.com)

ReplyDeleteI've been seeing posts and testimonials about BLANK ATM CARD but I never believed it, not until I tried it myself. It was on the 12th day of March. I was reading a post about places to visit in Slovakia when I saw this captivating post about how a Man described as Mr Harry changed his life with the help of a Blank Atm Card. I didn't believe it at first until I decided to reach him through the mail address attached to the post. To my greatest imagination, it was real. Right now am living up to a standard I never used to live before. Today might be your lucky day! Reach Mr Harry via email: (harrybrownn59@gmail.com) see you on the brighter side of life.

i was lost with no hope for my wife was cheating and had always got away with it because i did not know how or

ReplyDeletealways too scared to pin anything on her. with the help a friend who recommended me to who help hack her phone,

email, chat, sms and expose her for a cheater she is. I just want to say a big thank you to

HACKINTECHNOLOGY@CYBERSERVICES.COM . am sure someone out there is looking for how to solve his relationship problems, you can also contact him for all sorts of hacking job..he is fast and reliable. you could also text +1 213-295-1376(whatsapp) contact and thank me later

● Hello, we are offering service for Online CC /w High Balance which is ATM Card. You can use it anywhere in the world to withdraw money from any ATM machine. Contact us with the following email address: harrisonblankatmcard@gmail.com -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- --

ReplyDelete-- -- --------------What are the list, cost and how do i purchase the card? Contact us on: Email: harrisonblankatmcard@gmail.com

★ How it works? Our cards are loaded with balance of $5,000 to $100,000 with different daily withdraw limit depending on the card you are ordering and you can use the ATM card to withdraw cash anywhere.

★ Is this real? Yes, as shown in the video, we withdraw cash multiple times without any issues. You can do it too.

★ Can i be traced? No, your withdraw/transactions are completely anonymous.

★ Is this legal? We'll leave that for you to asnwer but we have not had any issues when doing this method. ★ Are people using this? Absolutely, people have quit most of their hard jobs to withdraw money instantly. Men and women use this card but we dont deal with kids or anyone below 18yrs

★ How do I get my card? We will ship your card with Pin 2 hours after receiving clear payment from you and the card will be send to you through courier delivery services. Our package usually delivered within 2-3 business day. Once you receive the card you can start cashing out.

★ Are you guys for real? YES: we are 100% real and been doing this since 2015 and once you withdraw with our card please do drop a comment right here for other people to see we are being serious here. -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- EMAIL US AT: harrisonblankatmcard@gmail.com or WhatsApp +15593840001

When investing in cryptocurrencies, one must exercise extreme caution. My capital investment was locked along with all of my returns at a binary investment firm, which was the exact issue I was having. Though I genuinely think there are legitimate businesses you can invest in, the difficulty is how to know for sure before making a decision. It was almost like watching a movie as the whole thing played out for me when I fell for these con artists posing as investors. Before it happened to me, I was unable to believe that such things exist. But when it turned out that I couldn’t withdraw my money, I started looking for a way to get it back. Fortunately, through recommendations from others, I was introduced to a recovery agent named Jeanson James Ancheta wizard. When I discovered that the scammers’ website had been taken down, Jeanson James Ancheta wizard Recovery was such a lifesaver; they were able to access it and helped me get my money back. I can’t be more grateful. You can catch up with them also via Email: (jeansonjamesanchetawizard62@gmail.com)

ReplyDeleteWhatsApp: +4531898073

Telegram number: +4571398534.